Important Takeaways:

- Most Americans realize that the federal government is drowning in debt and that inflation is out of control. But very few Americans can coherently explain where money comes from or how our financial system actually works. For decades, bankers that we do not elect have controlled America’s currency, have run our economy into the ground, and have driven the U.S. government to the brink of bankruptcy. The Federal Reserve is an institution that was designed to drain wealth from U.S. taxpayers and transfer it to the global elite. Have you ever wondered why a sovereign nation such as the United States has to borrow United States dollars from anyone? Have you ever wondered why a sovereign nation such as the United States does not even issue its own currency? Have you ever wondered why we allow a group of unelected private bankers to run our economy?

- The truth is that our financial system is centrally-controlled and centrally-managed by a group of banking oligarchs who oversee a constantly expanding debt spiral which could come crashing down at any time. If the American people truly understood how our system works, they would be protesting in the streets right now. The following are 11 reasons why the Federal Reserve is bad…

- 1 – The Federal Reserve was created as a way to enslave the U.S. government. In fact, the Federal Reserve System literally could not function without U.S. Treasury bonds. Government debt is at the very core of the system, and our federal government is now trapped in a debt spiral from which it can never possibly escape because the system is operating exactly as it was designed. Our national debt has been rising at an exponential rate, and that will continue to be the case until either the current system collapses or we adopt an entirely new system.

- 2 – The individual Federal Reserve Banks are not “federal” at all. In fact, on the official website of the Federal Reserve Bank of St. Louis, it is openly admitted that Federal Reserve Banks “are not a part of the federal government” and that private banks “hold stock in the Federal Reserve Banks and earn dividends”…

- 3 – Why does the Federal Reserve issue our currency? The U.S. Constitution explicitly gives Congress the power to issue our currency…

- [The Congress shall have Power . . . ] To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; . . .

- 4 – The Federal Reserve creates money out of thin air. I asked Google AI about this, and this is what I was told…

- Yes, the Federal Reserve (Fed) creates money out of thin air by increasing the money supply. This process is called “creating money out of thin air” because it involves adding funds to the economy without printing currency.

- 5 – The Federal Reserve devalues our currency. Since the Federal Reserve was created in 1913, the U.S. dollar has lost more than 96 percent of its purchasing power. The truth is that just a two percent inflation rate will wipe out half of your purchasing power within a single generation.

- 6 – The Federal Reserve manipulates the U.S. economy by setting interest rates. By moving rates higher or lower, the Federal Reserve has the power to create economic growth or to destroy it. They have the power to inflate massive economic bubbles and to pop them. Most Americans believe that our presidents “run the economy”, but the truth is that the Federal Reserve has far more control over the economy than the White House does.

- 7 – The Federal Reserve also controls the national money supply. They can pump trillions of dollars into the economy or pull trillions of dollars out of the economy without being accountable to anyone. This can have absolutely disastrous consequences. For example, inflation started getting wildly out of control after the Federal Reserve dramatically increased the size of the money supply during the pandemic.

- 8 – The Federal Reserve has become far, far too powerful. Our financial markets swing up and down whenever a Fed official makes an important statement, and every man, woman and child in the entire country is directly affected by the decisions that the Federal Reserve Board makes. Ron Paul once told MSNBC that he believes that the Federal Reserve has actually become more powerful than Congress…

- “The regulations should be on the Federal Reserve. We should have transparency of the Federal Reserve. They can create trillions of dollars to bail out their friends, and we don’t even have any transparency of this. They’re more powerful than the Congress.”

- 9 – The Federal Reserve is dominated by Wall Street and the New York banks. The New York representative is the only permanent member of the Federal Open Market Committee, while the other members rotate. The truth is that the Federal Reserve Bank of New York has always been the most important of the regional Fed banks by far, and in turn the Federal Reserve Bank of New York has always been dominated by Wall Street and the major New York banks.

- 10 – The Federal Reserve has completely eliminated minimum reserve requirements for our banks. Fractional reserve banking has always been a way that the bankers have conned the public, but now they have gotten rid of minimum reserve requirements altogether. This is literally insane.

- 11 – The Federal Reserve is not accountable to the voters, and Federal Reserve Chair Jerome Powell is flaunting the fact that he cannot even be fired by President Trump…

- Federal Reserve Chair Jerome Powell had a clear, direct response when asked during a press conference Thursday if he would step down if asked to do so by President-elect Trump.

- “No,” said Powell, whose term as chair ends in 2026.

- When asked to elaborate and if he would be legally required to leave, he again said, “No.”

- Powell later said it is “not permitted under the law” for the president to fire or demote him or any of the other Fed governors with leadership positions.

- Nobody knows what is really going on inside the Federal Reserve, because we aren’t allowed to see.

- Unfortunately, the truth is that they desperately do not want light to be shined on the elaborate “shell game” that they are running

- The system that we have now is clearly not working. The Federal Reserve was supposed to guarantee that our system would be perfectly stable, but in reality, our system has become much more unstable.

- It is time for different thinking.

Read the original article by clicking here.

Important Takeaways:

- In the largest planned pro-Palestinian action of the day, protesters are expected to march through Manhattan, from Wall Street to Columbus Circle

- A vigil to remember those killed and missing in last year’s Hamas attack on Oct. 7 will come within blocks of a pro-Palestinian march Monday night.

- NYPD officials are planning to keep both groups separate in what is expected to be the culmination of a tense day of protests and prayers.

- Smashed windows, red paint and graffiti including “divest now” was discovered spray-painted on the CUNY Advanced Science Research Center on the City College of New York campus in Hamilton Heights on Monday morning.

- At Columbia University, access is limited to ID holders in an effort to keep out outside agitators.

- More walkouts are expected in the afternoon, with both students and faculty from CUNY and city public schools gathering at Washington Square Park, to join the larger protest marching north.

- Blocks away in Central Park, a candle lighting ceremony with members of the Jewish community will remember those killed, with music and prayer

- Police officials say they are most concerned about the protest in Times Square, and the pro-Israeli prayer vigil in Central Park.

Read the original article by clicking here.

Important Takeaways:

- For the better part of six decades, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) CEO Warren Buffett has been one of Wall Street’s most-revered investors. Overseeing a cumulative return of more than 5,650,000% in Berkshire’s Class A shares (BRK.A) since becoming CEO has earned Buffett quite the following, as well as the nickname, “Oracle of Omaha.”

- But sometimes Berkshire’s quarterly operating results, or Form 4 filings with the Securities and Exchange Commission, can tell a more thorough story — even if it’s an unpleasant one.

- Recently, Buffett has been a somewhat aggressive seller of Bank of America (NYSE: BAC) stock. Between July 17 and Aug. 30, Berkshire’s stake in BofA has declined by about 150 million shares, equating to roughly $5.4 billion.

- This $5.4 billion in selling activity is a pretty clear warning to Wall Street and investors.

- The fact that Buffett has dumped nearly 15% of his company’s stake in Bank of America in a span of just over six weeks suggests clear worry about the U.S. economy and stock market. Like pretty much all bank stocks, BofA is cyclical.

- The other issue is it puts Berkshire Hathaway on track for its eighth consecutive quarter of selling more securities than it’s purchased.

- Collectively, Warren Buffett has overseen $131.6 billion more in securities sold than purchased between Oct 1, 2022 and June 30, 2024.

- But the bigger story is what price dislocation will attract Buffett next. Following the financial crisis, Buffett invested $5 billion into Bank of America preferred stock. This helped to shore up BofA’s balance sheet at a time when banks were Wall Street’s chopped liver. More importantly, it gave Buffett access to warrants entitling him the right to buy 700 million shares of BofA stock at $7.14 per share, which he did for Berkshire Hathaway in mid-2017.

- Periods of emotion-driven selling, while brief, have historically been Warren Buffett’s time to shine. With stocks at one of their priciest valuations in history, Buffett’s selling activity foreshadows both the peril and promise of what’s to come.

Read the original article by clicking here.

Important Takeaways:

- Dr. Phil Guest Exposes High-Tech Chinese Military Operations Near American Bases On U.S. Soil

- A map displayed on Dr. Phil Primetime showed how Chinese nationals are buying massive amounts of land surrounding American military bases.

- An expert named Kyle Bass of Hayman Capital Management explained how, in one instance, a Chinese military general named Sun bought over 100 square miles of land between America’s most active Air Force training base and the Mexico border.

- Bass noted Sun obtained a permit to build windmills on the land despite the location having a small amount of wind, saying, “They want to put up windmills for two reasons. They want to connect directly to the U.S. grid so that they can upload malware to the grid and they can monitor the grid.”

- He added, “They also want to build these windmills 700 feet tall. Imagine a windmill that’s almost as tall as the Washington Monument and they can put cameras up there that map the horizon and they can map the horizon with one square inch of clarity. Right next to our largest Air Force military training base. Every Air Force pilot trains at Laughlin Air Force Base.”

- Regarding the approval of the land purchases, Bass accused the U.S. Treasury of being a pawn of Wall Street and basically allowing China infiltrate the country in exchange for profit.

Read the original article by clicking here.

Revelations 13:16-18 “Also it causes all, both small and great, both rich and poor, both free and slave, to be marked on the right hand or the forehead, so that no one can buy or sell unless he has the mark, that is, the name of the beast or the number of its name. This calls for wisdom: let the one who has understanding calculate the number of the beast, for it is the number of a man, and his number is 666.”

Important Takeaways:

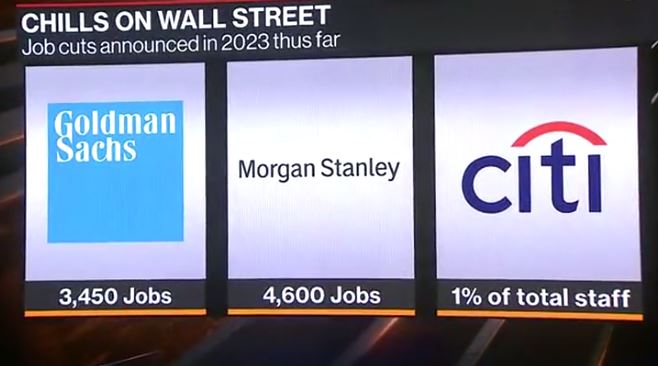

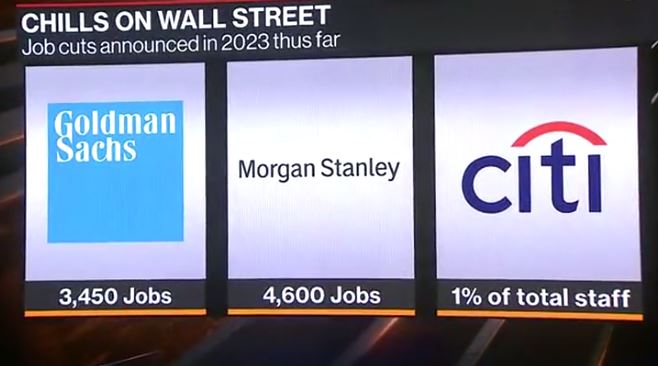

- Goldman Sachs to chop 250 more workers after ‘David’s Demolition Day,’ sources say

- Goldman Sachs plans to make another round of job cuts — its third in less than a year — as dealmaking profits continue to tank, sources told The Post on Tuesday.

- The David Solomon-led investment bank will cull an additional 250 workers on the heels of 3,200 being fired in January in what staff had dubbed “David’s Demolition Day,” an insider said.

- The latest layoffs could come in the next few weeks and the cuts will hit employees at every level including managing directors and other senior executives, according to the Wall Street Journal.

- In September, the Wall Street giant — which had 45,000 employees — had pink-slipped 1% to 5% of its under-performers.

- A Goldman Sachs spokesperson declined to comment.

Read the original article by clicking here.

Revelations 13:16-18 “Also it causes all, both small and great, both rich and poor, both free and slave, to be marked on the right hand or the forehead, so that no one can buy or sell unless he has the mark, that is, the name of the beast or the number of its name. This calls for wisdom: let the one who has understanding calculate the number of the beast, for it is the number of a man, and his number is 666.”

Important Takeaways:

- As talks over raising the U.S. government’s $31.4 trillion debt ceiling intensify, Wall Street banks and asset managers have begun preparing for fallout from a potential default.

- U.S. government bonds underpin the global financial system so it is difficult to fully gauge the damage a default would create, but executives expect massive volatility across equity, debt and other markets.

- Even a short breach of the debt limit could lead to a spike in interest rates, a plunge in equity prices, and covenant breaches in loan documentation and leverage agreements.

- Big bond investors have cautioned that maintaining high levels of liquidity was important to withstand potential violent asset price moves, and to avoid having to sell at the worst possible time.

Read the original article by clicking here.

Revelations 18:23:’For the merchants were the great men of the earth; for by thy sorceries were all nations deceived.’

Important Takeaways:

- Goldman Sachs is cutting up to 3,200 employees this week as Wall Street girds for tough year

- The global investment bank is letting go of as many as 3,200 employees starting Wednesday, according to a person with knowledge of the firm’s plans.

- That amounts to 6.5% of the 49,100 employees Goldman had in October, which is below the 8% reported last month as the upper end of possible cuts.

- Other investment banks are adopting a “wait and see” attitude: If revenues are tracking below estimates in February and March, the industry could cut more workers, said a person familiar with a leading Wall Street firm’s processes.

Read the original article by clicking here.

Revelations 18:23 ‘For the merchants were the great men of the earth; for by thy sorceries were all nations deceived.’

Important Takeaways:

- Morgan Stanley Warns of Something Worse Than a ‘Normal Recession’

- Morgan Stanley’s Chief U.S. Equity Strategist Michael Wilson said that he’s convinced a corporate earnings recession is coming—and that it could be worse than a “normal” recession.

- Businesses reluctant to cut staff in the face of deteriorating economic conditions and as demand falls would put more pressure on profit margins, he warned. This could lead to a situation where unemployment doesn’t move up meaningfully but corporate earnings plunge.

- Separately, in an analytical note cited by Bloomberg, Wilson and his team of strategists said the soaring dollar was creating an “untenable situation” for stocks and this, combined with central banks tightening policy “at a historically hawkish pace,” means that odds are growing for “something to break.”

Read the original article by clicking here.

Rev 6:6 NAS “And I heard something like a voice in the center of the four living creatures saying, “A quart of wheat for a denarius, and three quarts of barley for a denarius; and do not damage the oil and the wine.”

Important Takeaways:

- Biden threatens oil companies with ’emergency powers’ if they don’t boost supply amid inflation spike

- The letters represent Biden’s latest attempt to use executive action to curb inflationary pressure. Inflation currently sits at a 40-year high of 8.6% and shows no signs of slowing down.

- “Your companies and others have an opportunity to take immediate actions to increase the supply of gasoline, diesel and other refined product you are producing,” he continued. “My administration is prepared to use all reasonable and appropriate Federal Government tools and emergency authorities to increase refinery capacity and output in the near term, and to ensure that every region of this country is appropriately supplied.”

- The letters come one day after Biden ordered the sale of another 45 million barrels of crude oil from the U.S. Strategic Oil Reserve.

Read the original article by clicking here.

Rev 6:6 NAS And I heard something like a voice in the center of the four living creatures saying, “A quart of wheat for a denarius, and three quarts of barley for a denarius; and do not damage the oil and the wine.”

Important Takeaways:

- Inflation surges 7.5% on an annual basis, even more than expected and highest since 1982

- The consumer price index for all items rose 0.6% in January, driving up annual inflation by 7.5%.

- That marked the biggest gain since February 1982 and was even higher than the Wall Street estimate.

- Real earnings for workers increased just 0.1% on the month when accounting for inflation.

- Weekly jobless claims declined to 223,000, below the 230,000 estimate.

- On a percentage basis, fuel oil rose the most in January, surging 9.5% as part of a 46.5% year-over-year increase. Energy costs overall were up 0.9% for the month and 27% on the year.

- Vehicle costs, which have been one of the biggest inflation contributors since they began surging higher in the spring of 2021, were flat for new models and up 1.5% for used cars and trucks in January. The two categories have posted respective increases of 12.2% and 40.5% over the past 12 months.

- Shelter costs, which make up about one-third of the total CPI number, increased 0.3% on the month, which is the smallest gain since August 2021 and slightly below December’s rise. Still, the category is up 4.4% over the past year and could keep inflation readings elevated in the future.

- Food costs jumped 0.9% for the month and are up 7% over the past year.

Read the original article by clicking here.