Important Takeaways:

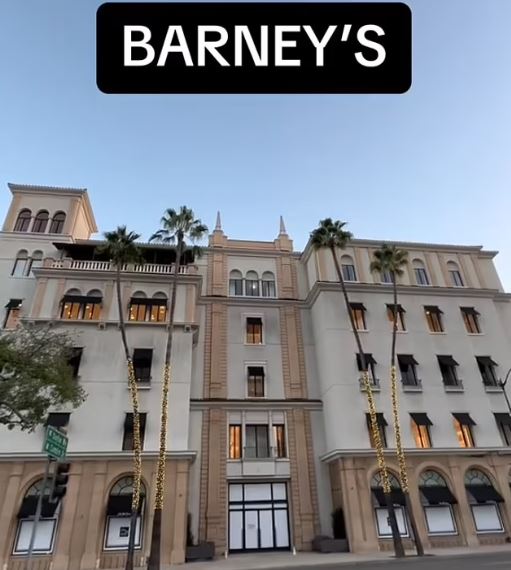

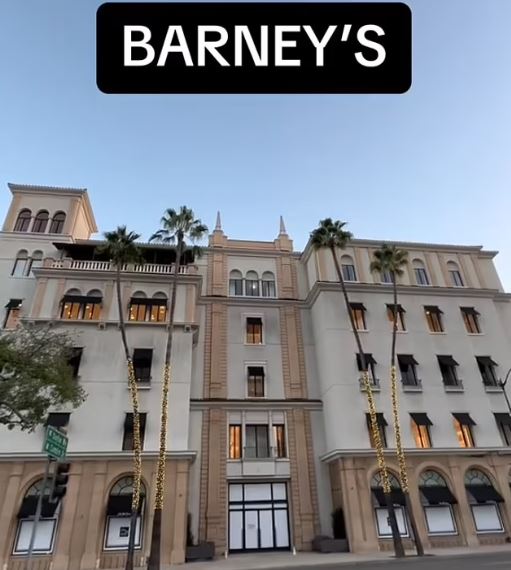

- RIP Beverly Hills: Startling video shows how once-thriving shopping mecca is now a desolate wasteland as high-end shops, banks, and restaurants shutter their doors amid economic woes and crime

- The closed shops, which also include convenience retailers like Rite Aid and Chipotle, and even popular workout class option SoulCycle, have shuttered their doors on Wilshire Boulevard, leaving the area bereft of its former appeal. Their sad decline marks a departure from the area’s lengthy heyday…

- The reasons for the ample number of closures vary, as many brands see a decrease in demand for in-person retail experiences, while others pivot business strategies following acquisitions by other brands. The downturned economy has also negatively impacted most brands, but especially those marketing luxury products.

- Businesses in Beverly Hills, and Los Angeles in general, are also in the midst of contending with a major spike in crime that has left many stores defenseless against mobs of robbers.

Read the original article by clicking here.

Important Takeaways:

- Inflation, unemployment and gross domestic product numbers are all giving Biden something to smile about.

- Even though Americans are making more than they did before the pandemic, their money is getting them a lot less than it did two and half years ago.

- While American paychecks are finally outpacing skyrocketing inflation, they have not been growing anywhere near as fast as prices have the last two and a half years

- People don’t like inflation, even when their wages are up, Americans will focus on the slow pace of real wage growth, rather than real wage growth alone.

Read the original article by clicking here.

Revelations 13:16-18 “Also it causes all, both small and great, both rich and poor, both free and slave, to be marked on the right hand or the forehead, so that no one can buy or sell unless he has the mark, that is, the name of the beast or the number of its name. This calls for wisdom: let the one who has understanding calculate the number of the beast, for it is the number of a man, and his number is 666.”

Important Takeaways:

- Yellen Faces a Diplomatic Test in Her High-Stakes Visit to China

- The Treasury secretary will need to defend export controls and tariffs while explaining that the United States does not aim to harm China’s economy.

- The trip, her first to the country as Treasury secretary, represents Ms. Yellen’s most challenging test of economic diplomacy to date as she attempts to ease years of festering distrust between the United States and China.

- For Ms. Yellen, the challenge will be to convince her Chinese counterparts that the bevy of U.S. measures blocking access to sensitive technology such as semiconductors in the name of national security are not intended to inflict harm on the Chinese economy.

- In her meetings in Beijing, Ms. Yellen is expected to make the case that the Biden administration’s actions to make the U.S. economy less reliant on China and to entice more production of critical materials inside the United States are narrowly focused measures that are not meant to instigate a broader economic war.

- China continues to hold nearly $1 trillion of U.S. debt and is America’s third-largest trading partner, making an abrupt severing of ties potentially calamitous for both countries and the global economy.

Read the original article by clicking here.

Ecclesiastes 5:8 If you see the extortion[a] of the poor, or the perversion[b] of justice and fairness in the government, [c] do not be astonished by the matter. For the high official is watched by a higher official, [d] and there are higher ones over them! [e]

Important Takeaways:

- …from Asia to Europe, they are all expressing complete shock that the United States is collapsing and they are now all seeing that our forecast that the 2024 Presidential Election would be the most corrupt in history and mark the END of democracy in the United States.

- These leftist people just do not get it. They crossed the line and now the view of the United States from the outside looking in, they no longer believe that America is the beacon of liberty to the world. It is becoming so obvious that our computer will be right again. I warned it even was showing that the 2024 election might not even take place. That was a small 18% probability, but that NEVER came up EVER in this history of running our political models – NEVER!

Read the original article by clicking here.

Revelations 13:16-18 “Also it causes all, both small and great, both rich and poor, both free and slave, to be marked on the right hand or the forehead, so that no one can buy or sell unless he has the mark, that is, the name of the beast or the number of its name. This calls for wisdom: let the one who has understanding calculate the number of the beast, for it is the number of a man, and his number is 666.”

Important Takeaways:

- Macy’s and Costco sound a warning about the economy

- Macy’s, Costco and other big chains say shoppers are pulling back at their stores and changing what they buy. That could be a red flag for the US economy.

- Macy’s (M) on Thursday cut its annual profit and sales forecast after customer demand slowed.

- “The US consumer, particularly at Macy’s, pulled back more than we anticipated,” Macy’s CEO Jeff Gennette said on an earnings call Thursday. Customers “reallocated” spending to food, essentials and services, he said.

- Macy’s and Costco appeal to middle- and higher-income shoppers, and their results show a pullback among that demographic.

- Dollar General (DG) said its core lower-income customers were passing up discretionary products like home goods and clothing.

- The company slashed its outlook on weak customer demand, sending its stock falling 20% during early trading Thursday.

- Beauty retailers have also seen strong sales as shoppers spend on smaller indulgences like makeup and lipstick.

Read the original article by clicking here.

Revelations 18:9-11 “The kings of the earth who committed fornication and lived luxuriously with her will weep and lament for her, when they see the smoke of her burning, 10 standing at a distance for fear of her torment, saying, ‘Alas, alas, that great city Babylon, that mighty city! For in one hour your judgment has come.’ 11 “And the merchants of the earth will weep and mourn over her, for no one buys their merchandise anymore

Important Takeaways:

- First Republic Bank seized by regulators, then sold to JPMorgan Chase

- Regulators seized control of First Republic Bank early Monday, making it the third financial institution taken under government control this year, then promptly accepted a bid from JPMorgan Chase for virtually all of the lender’s assets.

- The state’s Department of Financial Protection and Innovation (DFPI) said it had taken over San Francisco-based First Republic and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. The DFPI also said the FDIC has “accepted a bid from JPMorgan Chase Bank, National Association, Columbus, Ohio, to assume all deposits, including all uninsured deposits, and substantially all assets of First Republic Bank.”

- Before entering receivership First Republic shares had lost 97% of their value since January, taking more than $21 billion off First Republic’s market value.

- First Republic has $229 billion in assets, making it the second-biggest bank to collapse in U.S. history after the 2008 failure of Washington Mutual, which at the time had roughly $309 billion and which also was sold to JPMorgan.

- First Republic follows the March collapses of $210 billion Silicon Valley Bank and, only days later, of Signature Bank, both of which were seized by government regulators after experiencing bank runs

- The latest bank failure could cause other lenders to tighten credit and raise the cost of interbank loans

Read the original article by clicking here.

Revelations 13:16-18 “Also it causes all, both small and great, both rich and poor, both free and slave, to be marked on the right hand or the forehead, so that no one can buy or sell unless he has the mark, that is, the name of the beast or the number of its name. This calls for wisdom: let the one who has understanding calculate the number of the beast, for it is the number of a man, and his number is 666.”

Important Takeaways:

- Poll: 75% of Americans Think Economy Is Getting Worse

- Interactive Poll shows – While 75 percent of Americans say the economy is worsening, only 19 percent say things are improving, and five percent say the economy is stagnant.

- The percentage of Americans who believe economic conditions are getting worse has increased in recent months, up from 68 percent in February and 72 percent in March.

- Compared to the same point in former President Donald Trump’s term, more Americans thought the economy was getting better rather than worse, with 49 percent seeing an improvement compared to 44 percent who saw a decline.

- Gallup’s survey also found that 48 percent of Americans have almost no faith in Biden’s ability to do or recommend the right thing for the economy.

Read the original article by clicking here.

Luke 21:25 “And there will be signs in sun and moon and stars, and on the earth distress of nations in perplexity because of the roaring of the sea and the waves

Important Takeaways:

- Argentina’s ‘unprecedented’ drought pummels farmers and economy

- A historic drought ravaging Argentina’s crops is deepening the grain exporting giant’s economic crisis, crushing farmers across the Pampas, heightening default fears and putting at risk targets agreed with the International Monetary Fund (IMF).

- The South American nation, the world’s top exporter of processed soy and No. 3 for corn, is in the grip of it worst drought in over 60 years, which has led to repeated sharp cuts to soybean and corn harvest forecasts.

- Those were cut again on Thursday by the Buenos Aires grains exchange after the Rosario exchange slashed its soy production outlook to 27 million tonnes, the lowest since the turn of the century, when far less of the crop was planted.

- …farmers were facing losses of $14 billion and 50 million tonnes less of grain output across soy, corn and wheat.

- “It’s unprecedented that the three crops fail. We are all waiting for it to rain,” he added.

Read the original article by clicking here.

Revelations 13:16-18 “Also it causes all, both small and great, both rich and poor, both free and slave, to be marked on the right hand or the forehead, so that no one can buy or sell unless he has the mark, that is, the name of the beast or the number of its name. This calls for wisdom: let the one who has understanding calculate the number of the beast, for it is the number of a man, and his number is 666.”

Important Takeaways:

- #1 We were warned that a great commercial real estate crisis would be coming, and now it is here.

- With recent stress in the regional banking sector, sentiment in US commercial real estate (CRE) – and especially the office sector – has turned negative as investors prepare for potential spillover effects (with JPM, Morgan Stanley, and Goldman Sachs all joining the gloom parade), especially as high-profile defaults continue to make headlines as borrowers face higher debt service costs and refinancing becomes much harder ahead of a $400 billion CRE debt maturities this year alone…

- #2 We were warned that there would be widespread layoffs as economic conditions in the United States deteriorated. Sadly, that is now happening all around us. For example, on Monday accounting firm Ernst & Young announced that they will be laying off thousands of highly paid workers…

- #3 We were warned that the largest corporate debt bubble in the history of the world would eventually burst, and now corporations are beginning to default on their debts at a rate that should deeply alarm all of us…

- #4 We were warned that we would witness a dramatic surge in bankruptcies in 2023, and that is precisely what is happening…

- Bankruptcy filings across the United States rose for the third straight month in March in all major industries. A total of 42,368 new bankruptcies were filed last month, according to data from Epiq Bankruptcy, a provider of U.S. bankruptcy court data, technology, and services.

- #5 We were warned that the rest of the world would eventually start rejecting the U.S. dollar, and now “de-dollarization” is happening at a “stunning” pace…

Read the original article by clicking here.

Revelations 13:16-18 “Also it causes all, both small and great, both rich and poor, both free and slave, to be marked on the right hand or the forehead, so that no one can buy or sell unless he has the mark, that is, the name of the beast or the number of its name. This calls for wisdom: let the one who has understanding calculate the number of the beast, for it is the number of a man, and his number is 666.”

Important Takeaways:

- Inflation, economic instability and a lack of savings have an increasing number of Americans feeling financially stressed.

- Some 70% of Americans admit to being stressed about their personal finances these days and a majority — 52% — of U.S. adults said their financial stress has increased since before the Covid-19 pandemic began in March 2020, according to a new CNBC Your Money Financial Confidence Survey conducted in partnership with Momentive.

- “People are worried that the money they’ve saved won’t last and are worried they’re going to have to lean more on their credit cards and other sources of debt just to get by,” said Bruce McClary, a senior vice president at the National Foundation for Credit Counseling.

- Bank failures weaken confidence

- About a third of people earning six figures said they are living paycheck to paycheck and more than a quarter said they have no emergency fund.

Read the original article by clicking here.